When you hear the term "Modified Adjusted Gross Income," it's easy for your eyes to glaze over. It sounds like complicated tax jargon, right? But if you want to get affordable health insurance, this is one piece of "tax-speak" you'll definitely want to understand.

Think of Modified Adjusted Gross Income (MAGI) as a special number the government uses to see if you qualify for certain benefits, especially health insurance subsidies through the Affordable Care Act (ACA). It's not a figure you'll find neatly printed on your tax return. Instead, MAGI is a number you calculate, and it all starts with a familiar figure: your Adjusted Gross Income (AGI).

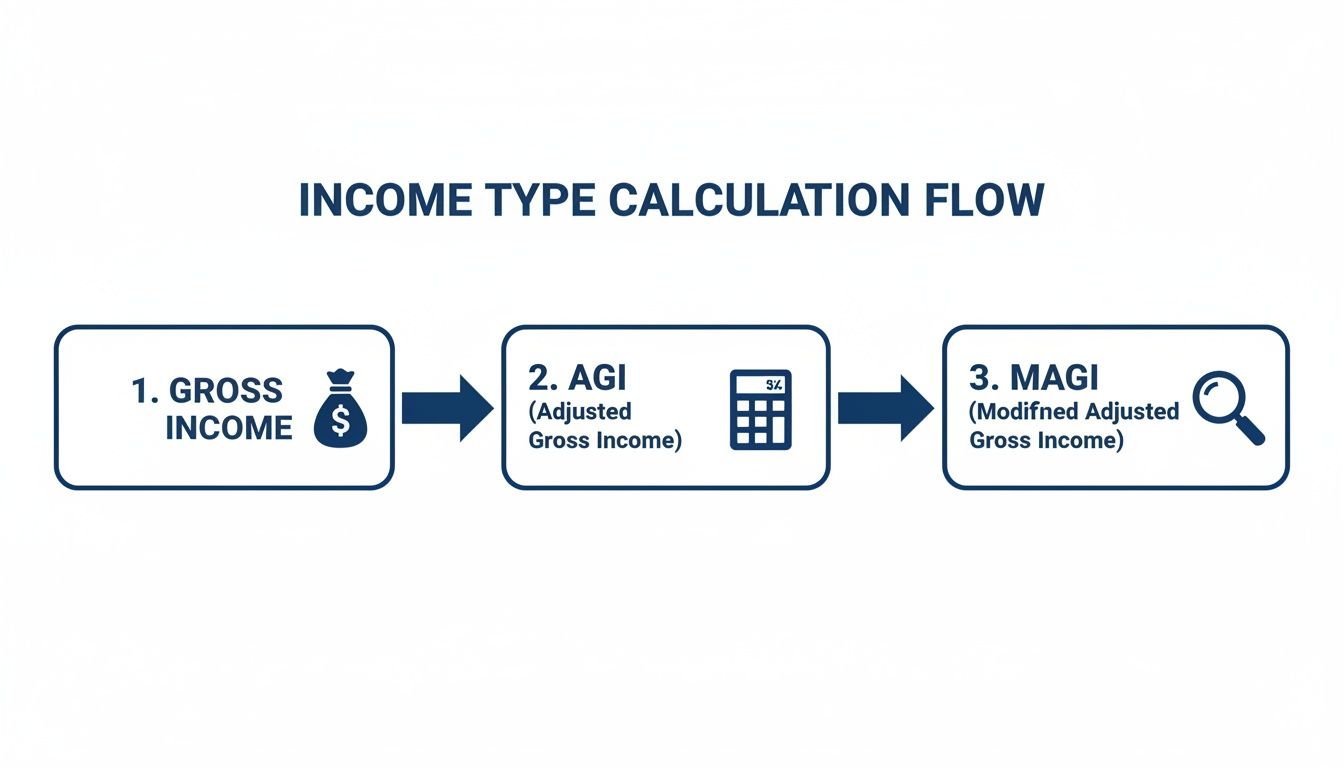

From Gross Income to MAGI: What's the Difference?

To really get what MAGI is, it helps to understand how it's built. Think of it like a recipe. You start with all your income, then you subtract a few things, and finally, you add a couple of specific items back in. Let's break down the ingredients.

The Journey From Your Total Paycheck to MAGI

It all begins with your Gross Income. This is every single dollar you earn before any taxes or deductions are taken out. It includes your salary, wages, tips, side hustle income, investment profits, and rental income—basically, your total financial picture in its rawest form.

From there, we get to your Adjusted Gross Income (AGI). This is a critical number you'll find on Line 11 of your IRS Form 1040. To get your AGI, you subtract certain "above-the-line" deductions from your Gross Income. These are specific adjustments for things like:

- Contributions to a traditional IRA

- Student loan interest you've paid

- One-half of your self-employment taxes

- Contributions to a health savings account (HSA)

These deductions lower your taxable income, which is great for your tax bill. But for some government programs, AGI doesn't tell the whole story. That's where MAGI comes in.

Why it matters: For ACA purposes, MAGI is your AGI with a few specific tax-free items added back in. The most common "add-backs" are non-taxable Social Security benefits, tax-exempt interest, and foreign-earned income. This gives the government a more accurate look at the money you actually have available to spend.

A Quick Glance: Gross Income vs. AGI vs. MAGI

| Income Figure | What It Includes | Key Deductions or Add-Backs |

|---|---|---|

| Gross Income | All income from all sources (wages, self-employment, investments) before any deductions. | None. This is your total, raw earnings. |

| Adjusted Gross Income (AGI) | Your Gross Income minus specific "above-the-line" deductions. | Student loan interest, traditional IRA contributions, HSA contributions, and other adjustments are subtracted. |

| Modified Adjusted Gross Income (MAGI) | Your AGI with certain tax-free income and deductions added back in. | For ACA purposes, this adds back tax-exempt interest, non-taxable Social Security, and foreign-earned income. |

Why Isn't There Just One Universal MAGI?

Here's something that trips up a lot of people: the MAGI formula isn't always the same. The calculation can actually change depending on the specific tax benefit you're looking at.

For instance, the MAGI formula for ACA subsidies is different from the one used for Roth IRA contributions. It's crucial to remember that Modified Adjusted Gross Income (MAGI) is more of a concept than a single fixed number.

This specific MAGI figure is the key that unlocks premium tax credits, which can dramatically lower your monthly health insurance payments. It's also tied directly to the Federal Poverty Level (FPL), the income thresholds used to determine subsidy amounts. To see how your income might stack up, check out our guide on the 2026 Federal Poverty Level.

How to Calculate Your MAGI: A Step-by-Step Guide

Calculating your Modified Adjusted Gross Income might sound like a job for an accountant, but for ACA purposes, it's a pretty straightforward process. The formula is simple: you start with your Adjusted Gross Income (AGI) and just add back a few specific things.

Step 1: Find Your Adjusted Gross Income (AGI)

First things first, you need your AGI. The good news? You don't have to calculate this from scratch. It's printed right on your federal tax return.

Pull out your most recent tax documents and look for Adjusted Gross Income (AGI) on Line 11 of your IRS Form 1040. This number is your starting point.

Step 2: Add Back Three Specific Income Items

Here's where the "modified" part comes in. To figure out your MAGI for the ACA Marketplace, you only need to add back three types of non-taxed income to your AGI.

For the ACA, the only three things you need to add back are:

- Tax-Exempt Interest: Did you earn interest from sources like municipal bonds? Since it's not federally taxed, it wasn't counted in your AGI. You can find this amount on Line 2a of your Form 1040.

- Non-Taxable Social Security Benefits: This includes the portion of any Social Security income (like retirement or disability benefits) that you didn't have to pay income tax on. You can find this by reviewing your Social Security Benefit Statement, Form SSA-1099.

- Foreign Earned Income: If you lived and worked abroad, this is any income you were able to exclude from your U.S. taxes, typically reported on Form 2555.

A Practical Example: Calculating MAGI for a Family

Sarah and Tom's MAGI Calculation

Let's see how this works in the real world. Meet Sarah and Tom, a married couple filing their taxes jointly.

Here's a snapshot of their finances for the year:

- Combined AGI: Their Adjusted Gross Income from Line 11 of their Form 1040 is $65,000.

- Tax-Exempt Interest: They earned $500 from some municipal bonds.

- Non-Taxable Social Security: Tom started receiving Social Security, and the non-taxable portion of his benefits totaled $10,000.

- Foreign Earned Income: They didn't have any, so this is $0.

MAGI = AGI + Tax-Exempt Interest + Non-Taxable Social Security Benefits + Foreign-Earned Income

MAGI = $65,000 + $500 + $10,000 + $0 = $75,500

Their final MAGI comes out to $75,500. This is the exact number the Health Insurance Marketplace will use to determine the size of their premium tax credit.

Why MAGI is the Magic Number for Health Insurance Subsidies

So, you've figured out what Modified Adjusted Gross Income is and how to calculate it. Now for the most important part: why does this number matter so much?

When it comes to the Affordable Care Act (ACA), your MAGI isn't just a random figure. It's the master key that determines your eligibility for the Premium Tax Credit (PTC)—the subsidy that makes Marketplace health plans affordable for millions of Americans.

How MAGI Connects to the Federal Poverty Level (FPL)

Here's how the process works: the ACA Marketplace takes your MAGI and compares it to the Federal Poverty Level (FPL) for your household size. The FPL is a set of income thresholds the government updates each year to figure out who qualifies for federal aid.

Your eligibility for a health insurance subsidy all comes down to where your MAGI lands as a percentage of that FPL. It's a direct relationship:

- A lower MAGI compared to the FPL means you could qualify for a bigger subsidy.

- A higher MAGI will likely lead to a smaller subsidy, or possibly none at all.

Why this matters to you: Understanding your MAGI gives you power. By strategically managing your income and taking the right deductions, you can directly influence how much you pay for health insurance each month.

MAGI and Subsidy Eligibility at a Glance

| Your MAGI (as a % of FPL) | Typical Subsidy Eligibility | What This Means For You |

|---|---|---|

| Below 100% | Generally ineligible for Marketplace subsidies. | In states that expanded Medicaid, you'll likely qualify for that instead. In non-expansion states, you may be in the "coverage gap." |

| 100% to 150% | Highest subsidy eligibility. | You'll likely have access to plans with very low (or even $0) monthly premiums and significantly reduced out-of-pocket costs. |

| 150% to 250% | Strong subsidy eligibility. | You can expect substantial help with your monthly premiums and may also qualify for some cost-sharing reductions. |

| 250% to 400% | Moderate subsidy eligibility. | You'll still receive a meaningful subsidy to help lower your monthly insurance costs. |

| Above 400% | Still eligible if premiums exceed 8.5% of your MAGI. | Thanks to rules extended by the Inflation Reduction Act through 2025, you can get a subsidy if the benchmark plan costs more than 8.5% of your income. |

Calculate Your MAGI Impact

See how your MAGI translates into real savings. Use our free ACA Subsidy Calculator to get a personalized estimate.

Try the Calculator →Real-Life Scenarios: See MAGI in Action

Formulas and tables are helpful, but seeing how MAGI works for real people makes it all click. Let's walk through a few common scenarios to see how different financial situations affect the final MAGI calculation.

Scenario 1: The Freelance Graphic Designer

Maria's MAGI

Meet Maria, a single freelance graphic designer. Her income can change from month to month, so understanding her MAGI is key to getting affordable health coverage.

Here's a look at her finances:

- Gross Income from Clients: Maria billed a total of $65,000.

- Business Expenses: She had $10,000 in legitimate expenses (software, marketing), bringing her net self-employment income to $55,000.

- Self-Employment Tax Deduction: She can deduct one-half of her self-employment tax, which is $3,885.

- HSA Contribution: She smartly contributed $3,000 to her Health Savings Account.

First, let's find Maria's AGI:

AGI = $55,000 (Net Income) - $3,885 (SE Tax Deduction) - $3,000 (HSA) = $48,115

Now for her MAGI. Maria had no foreign income, non-taxable Social Security, or tax-exempt interest to add back. So, her calculation is simple:

MAGI = $48,115 (AGI) + $0 (Add-Backs) = $48,115

This is the number the Marketplace will use to calculate her subsidy.

Scenario 2: The Married Couple with Mixed Income

David and Jessica's MAGI

Next, let's look at David and Jessica, who file their taxes jointly. David is a teacher with a W-2 salary, and Jessica works part-time.

Here's their financial breakdown:

- David's W-2 Salary: $70,000

- Jessica's Part-Time Income: $20,000

- Student Loan Interest Paid: They deducted $1,500.

- Tax-Exempt Interest: They earned $500 from municipal bonds.

Let's start with their AGI:

AGI = ($70,000 + $20,000) - $1,500 (Student Loan Interest) = $88,500

Now for their MAGI. The student loan interest deduction is not added back for ACA purposes, but their tax-exempt interest is.

MAGI = $88,500 (AGI) + $500 (Tax-Exempt Interest) = $89,000

Their MAGI of $89,000 is the number that matters for their subsidy calculation.

Scenario 3: The Early Retiree

Frank's MAGI

Finally, let's meet Frank, a 62-year-old early retiree. He lives on retirement account distributions and Social Security. For him, carefully managing his MAGI is crucial for keeping his healthcare affordable.

Here's Frank's annual income:

- Traditional IRA Distributions: He took out $30,000 (all taxable).

- Roth IRA Distributions: He also took a $10,000 qualified distribution (tax-free).

- Social Security Benefits: He received $24,000, and $14,000 of it is non-taxable.

Let's find Frank's AGI. This only includes his taxable income. The tax-free Roth money doesn't count.

AGI = $30,000 (Traditional IRA) + $10,000 (Taxable Social Security) = $40,000

Now for the MAGI calculation. We must add back the non-taxable portion of his Social Security.

MAGI = $40,000 (AGI) + $14,000 (Non-Taxable Social Security) = $54,000

This is a perfect example of why MAGI is so important for retirees. While his AGI is a modest $40,000, his MAGI is significantly higher, which could impact his subsidy eligibility.

What to Do When Your Income Changes Mid-Year

Life happens. You might get a new job, start a side gig, or face an unexpected layoff. When your income changes, so does your Modified Adjusted Gross Income (MAGI).

The MAGI you report when you first sign up for an ACA plan is just your best guess for the year. If your financial situation changes, it's critical to update it.

Why You Must Report Income Changes

Failing to report a significant income increase is a common and costly mistake. You'll keep getting a large subsidy based on your old, lower income. But when you file your taxes, the IRS will compare the subsidy you received with what you were actually eligible for based on your final MAGI.

If you were overpaid, you'll have to pay back some or all of that subsidy. This can lead to a smaller tax refund or even a surprise tax bill.

On the flip side, if your income decreases and you don't report it, you'll be overpaying for health insurance every month and won't get that money back until tax time.

Common Life Events That Affect Your MAGI

You should update your Marketplace application if you experience changes like:

- Getting a raise or a new, higher-paying job.

- Losing a job or taking a pay cut.

- Starting a side business or freelance work.

- Changes in your household (getting married, divorced, or having a baby).

For a detailed walkthrough, you can learn more about how to estimate your income for ACA subsidies in our dedicated guide.

Your MAGI Questions, Answered (FAQ)

Even after walking through the steps, a few questions often pop up. Let's tackle the most common ones.

Does my 401(k) or IRA withdrawal count toward MAGI?

Yes, in most cases. Withdrawals from traditional 401(k)s and traditional IRAs are taxable income. Because that money is part of your Adjusted Gross Income (AGI), it automatically gets counted in your MAGI.

However, qualified distributions from a Roth IRA or Roth 401(k) are tax-free. They don't show up in your AGI, so they do not count toward your MAGI. For retirees, this is a key distinction for managing subsidy eligibility.

What is the difference between MAGI for the ACA and MAGI for a Roth IRA?

This is a great question because it highlights a common point of confusion. MAGI is not a universal number. The formula changes depending on why you're calculating it.

- For the ACA, the formula is simple: AGI + non-taxable Social Security + tax-exempt interest + foreign-earned income.

- For Roth IRA contributions, the MAGI calculation is different and may require adding back other deductions, like student loan interest.

Always check the specific rules for the benefit you're interested in.

I'm self-employed. How do I calculate my MAGI?

For the self-employed, your starting point is the net profit from your business (your Schedule C income). That figure becomes a major part of your AGI. From there, the process is the same: you add back tax-exempt interest, non-taxable Social Security, or foreign income if they apply to you.

Pro-Tip: Deductions like one-half of your self-employment tax, self-employed health insurance premiums, and contributions to a SEP IRA all lower your AGI. Since these are not added back for the ACA MAGI calculation, they are powerful tools for managing your MAGI and qualifying for a larger subsidy.

Learn more in our guide on ACA subsidies for self-employed individuals.

Key Takeaways

- MAGI Starts with Your Tax Return: To find your MAGI for the ACA, start with your Adjusted Gross Income (AGI) from Line 11 of your Form 1040.

- Add Back Just Three Things: Add back any non-taxable Social Security benefits, tax-exempt interest, and foreign-earned income you may have.

- MAGI is the Key to Subsidies: The Health Insurance Marketplace uses this final MAGI number to determine your eligibility for premium tax credits that lower your monthly insurance bill.

- Keep it Updated: Your MAGI is an estimate. Report any life or income changes to the Marketplace right away to avoid a surprise tax bill.

Ready to See How Your MAGI Translates into Real Savings?

Use our free ACA Subsidy Calculator to get a personalized estimate of the financial help you could receive. It only takes a minute and can help you plan your healthcare budget with confidence.

Calculate Your Subsidy →